Discover the ultimate guide. How to Invest in the Stock Market for Beginners. From risk tolerance and asset allocation to tax considerations and investment strategies, we cover everything you need to become a savvy investor. Start your investment journey today!

Unlock the secrets of successful investing with this ultimate guide. From understanding risk tolerance to tax considerations, we cover everything you need to know to start investing in the stock market.

Introduction

Investing in the stock market can seem like a labyrinth of options and decisions, especially for beginners. This ultimate guide aims to equip you with the knowledge and tools you need to navigate the financial markets confidently. Whether you’re looking to grow your wealth, save for retirement, or anything in between, we’ve got you covered.

Table of Contents

- Understanding the Basics

- Financial Literacy

- Investment Options

- Asset Allocation

- Economic Factors to Consider

- Tax Considerations

- Robo-Advisors vs. Human Advisors

- Investment Strategies

- Market Timing

- Behavioral Economics

- Tracking and Analysis Tools

- Investment Tools and Resources

- Regulatory Considerations

- Case Studies

- FAQ

- Glossary

- Conclusion

Understanding the Basics

Risk Tolerance

What is Risk Tolerance?

Risk tolerance is your ability to endure fluctuations in the value of your investments without experiencing undue stress or financial hardship. It’s a combination of your emotional comfort level and your financial capacity to absorb losses.

Why is it Important?

Understanding your risk tolerance is crucial because it helps you select investment options that you are comfortable with. Investing in something too risky can lead to stress and poor decision-making, while being too conservative may result in returns that don’t meet your financial goals.

How to Assess Your Risk Tolerance

There are various ways to assess your risk tolerance, including questionnaires provided by financial advisors or online platforms. These assessments often consider factors like your age, financial situation, investment goals, and past experiences with risk.

Tailoring Investments to Your Risk Tolerance

Once you understand your risk tolerance, you can tailor your investment choices accordingly. For example, if you have a low risk tolerance, you might opt for safer investments like bonds or money market funds. Conversely, a high risk tolerance might lead you to invest in stocks or even more volatile assets like cryptocurrencies.

Investment Goals

What are Investment Goals?

Investment goals are the financial objectives you aim to achieve through your investment activities. These could range from short-term goals like saving for a vacation to long-term goals like retirement planning.

Importance of Setting Clear Goals

Having clear and specific investment goals allows you to develop a focused investment strategy. It helps you decide which investment vehicles are most suitable for achieving your objectives.

Types of Investment Goals

- Short-term Goals: These are goals you aim to achieve within a year or less, such as saving for a holiday or emergency fund.

- Medium-term Goals: These goals take between one to five years to achieve, like buying a car or funding higher education.

- Long-term Goals: These are goals that take more than five years to achieve, such as buying a home or retirement planning.

Aligning Goals with Investments

Different investment options are suitable for different types of goals. For instance, if you’re saving for retirement, long-term investments like stocks or retirement accounts may be more appropriate. For short-term goals, you might consider more liquid and less volatile options like a savings account or short-term bonds.

Time Horizon

What is Time Horizon?

Your time horizon is the estimated period you plan to hold an investment before you’ll need access to your capital.

Importance of Time Horizon

Your time horizon significantly impacts your investment strategy. A longer time horizon allows you to take on more risk because you have more time to recover from market downturns. A shorter time horizon may require a more conservative approach.

How to Determine Your Time Horizon

Your time horizon is closely linked to your investment goals. For example, if you’re investing for retirement and you’re currently 30 years old, your time horizon may be 30-40 years. On the other hand, if you’re saving for a down payment on a house that you plan to buy in 5 years, your time horizon would be much shorter.

Diversification

What is Diversification?

Diversification involves allocating your investments across various asset classes, sectors, or geographical locations to reduce risk.

Why is Diversification Important?

Diversification helps to mitigate the impact of poor performance in any single investment. By spreading your risk, you are less likely to suffer significant losses when one asset class or sector underperforms.

How to Diversify Your Portfolio

- Asset Class Diversification: Spread your investments across different types of assets like stocks, bonds, and real estate.

- Sector Diversification: Within an asset class like stocks, consider diversifying across different sectors such as technology, healthcare, and consumer goods.

- Geographical Diversification: Consider investing in assets from different countries or regions to protect against local economic downturns.

By understanding these fundamental concepts, you’ll be better equipped to navigate the complexities of the investment world and make informed decisions that align with your financial goals and risk tolerance.

Financial Literacy

Why is Financial Literacy Important?

Financial literacy is the foundation upon which successful investing is built. It equips you with the knowledge and skills needed to make informed decisions, assess investment opportunities, and understand the risks involved. Without a basic understanding of financial terms and concepts, you’re essentially navigating the investment landscape blindfolded.

Key Financial Terms Explained

Dividends

- What Are Dividends?: Dividends are payments made by a corporation to its shareholders, usually in the form of cash or additional shares.

- Why They Matter: Dividends can provide a steady income stream and are often considered a sign of a company’s financial health.

Capital Gains

- What Are Capital Gains?: Capital gains refer to the increase in the value of an investment over time. When you sell the investment for more than you paid for it, you realize a capital gain.

- Why They Matter: Understanding capital gains is essential for tax planning, as different tax rates may apply depending on how long you’ve held the asset.

P/E Ratio (Price-to-Earnings Ratio)

- What Is the P/E Ratio?: The P/E ratio is a valuation metric that compares a company’s current share price to its per-share earnings.

- Why It Matters: A high P/E ratio could indicate that a stock is overvalued, while a low P/E ratio may suggest undervaluation or a lack of investor confidence.

Yield

- What Is Yield?: Yield refers to the income return on an investment and is usually expressed as a percentage.

- Why It Matters: Yield can help you evaluate the profitability of an investment relative to its cost or market value.

How to Improve Your Financial Literacy

Read Widely

Books, articles, and financial news can provide valuable insights. Consider starting with classics like “The Intelligent Investor” by Benjamin Graham or “Rich Dad Poor Dad” by Robert Kiyosaki.

Take Online Courses

There are numerous online platforms offering courses on finance and investment. Websites like Coursera, Udemy, and Khan Academy provide a range of courses that cater to different skill levels.

Consult a Financial Advisor

If you’re new to investing, consulting a financial advisor can provide personalized guidance tailored to your financial situation and goals.

Use Financial Tools and Apps

Many online tools and apps can help you track your investments, budget your finances, and even offer investment suggestions. Tools like Mint for budgeting or Morningstar for investment analysis can be incredibly useful.

By investing time in improving your financial literacy, you not only become a more informed investor but also gain the confidence to make smarter financial decisions.

Investment Options

Stocks

Stocks offer ownership in a company. They are high-risk, high-reward investments suitable for those with a longer time horizon and higher risk tolerance.

Bonds

Bonds are debt instruments that pay periodic interest and return the principal at maturity. They are generally safer than stocks but offer lower returns.

Mutual Funds and ETFs

Mutual funds and ETFs provide diversification in a single investment. Mutual funds are actively managed, while ETFs usually track an index.

Real Estate and Commodities

Investing in real estate or commodities like gold and oil can offer diversification benefits. However, these investments come with their own set of risks and should be considered carefully.

Asset Allocation

Asset allocation involves dividing your investments among different asset classes like stocks, bonds, and real estate based on your risk tolerance, investment goals, and time horizon. A well-thought-out asset allocation can help you achieve more consistent returns over time.

Economic Factors to Consider

Inflation Rate

Inflation can erode the purchasing power of your investment returns. Look for investments that offer returns higher than the inflation rate to ensure real growth of your capital.

Interest Rates

Interest rates affect the cost of borrowing and the yield on bonds and savings accounts. Higher interest rates often lead to lower stock prices but can offer better returns on fixed-income investments.

Tax Considerations

Different investments come with varying tax implications. For instance, long-term capital gains are usually taxed at a lower rate than short-term gains. Understanding the tax consequences can help you keep more of your earnings.

Robo-Advisors vs. Human Advisors

Robo-advisors offer automated investment advice based on algorithms, usually at a lower cost. Human advisors provide personalized advice and can handle more complex financial situations. Both have their pros and cons, and the best choice depends on your specific needs.

Investment Strategies

Investment strategies are the frameworks or guidelines that investors follow when choosing how to allocate their assets. Different strategies cater to different investment goals, risk tolerances, and time horizons. Here, we’ll explore three popular investment strategies: Dollar-Cost Averaging, Value Investing, and Growth Investing.

Dollar-Cost Averaging

What is Dollar-Cost Averaging?

Dollar-Cost Averaging (DCA) is an investment strategy where you invest a fixed amount of money into a particular asset at regular intervals, regardless of its price.

Why is it Important?

DCA is a disciplined approach that aims to reduce the impact of market volatility. By investing consistently over time, you buy more shares when prices are low and fewer shares when prices are high, which can result in a lower average cost per share over time.

How to Implement Dollar-Cost Averaging

- Choose an Asset: Decide on the asset you want to invest in, such as a specific stock or mutual fund.

- Set a Budget: Determine the fixed dollar amount you will invest at each interval.

- Select an Interval: Decide how often you will invest—weekly, bi-weekly, monthly, etc.

- Execute: Use a brokerage account to set up automatic investments based on your chosen interval and amount.

Value Investing

What is Value Investing?

Value investing involves identifying and buying stocks that appear to be trading for less than their intrinsic or book value.

Why is it Important?

Value investing is based on the idea that the stock market often misprices stocks. By conducting thorough research, you can buy undervalued stocks and hold them until the market corrects, resulting in a profit.

How to Implement Value Investing

- Research: Use financial metrics like P/E ratios, dividend yields, and debt-to-equity ratios to identify undervalued stocks.

- Analyze: Look at the company’s fundamentals, including its financial statements, management team, and market position.

- Invest: Once you’ve identified an undervalued stock, invest a portion of your portfolio in it.

- Hold: Be prepared to hold the stock for an extended period until it reaches its true value.

Growth Investing

What is Growth Investing?

Growth investing focuses on investing in companies that are expected to grow at an above-average rate compared to other firms in the market.

Why is it Important?

Growth stocks have the potential to deliver higher returns compared to the broader market. However, they also come with higher volatility and risk.

How to Implement Growth Investing

- Identify Growth Sectors: Look for industries that are expected to experience above-average growth, such as technology or renewable energy.

- Select Companies: Within those sectors, identify companies with strong growth prospects.

- Analyze Metrics: Consider metrics like revenue growth, earnings per share (EPS), and projected future growth.

- Invest: Allocate a portion of your portfolio to these growth stocks, keeping in mind your risk tolerance and diversification needs.

By understanding and implementing these investment strategies, you can better align your investment choices with your financial goals, risk tolerance, and time horizon.

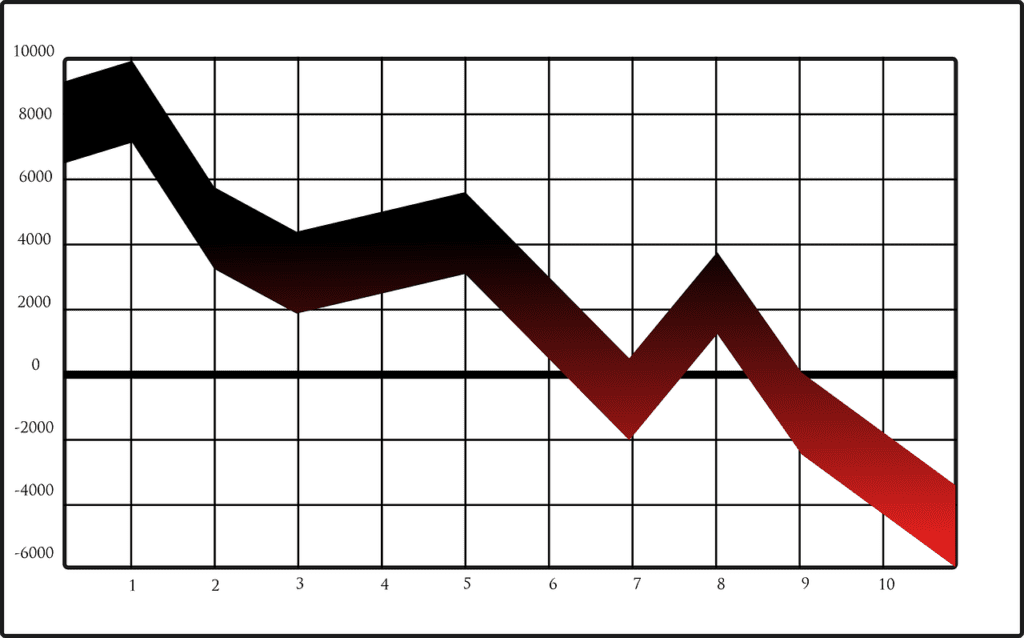

Market Timing

What is Market Timing?

Market timing is an investment strategy that involves buying and selling financial assets with the aim of capitalizing on price fluctuations. The goal is to buy low and sell high, thereby maximizing returns. This strategy often involves closely monitoring market trends, economic indicators, and other financial data.

Why is Market Timing Risky?

Volatility

Financial markets are inherently volatile, influenced by a myriad of factors ranging from economic data releases to geopolitical events. This makes predicting short-term price movements extremely challenging.

Emotional Decision-Making

Market timing often leads to emotional investing, where decisions are made based on fear or greed rather than rational analysis. This can result in poor investment choices and potential losses.

Transaction Costs

Frequent buying and selling incur transaction costs, which can erode profits. These costs can add up quickly, especially if the strategy doesn’t yield the expected returns.

Opportunity Cost

By attempting to time the market, investors may miss out on periods of exceptional returns. Even missing just a few of the best days in the market can significantly impact overall performance.

The Alternative: Time “In” the Market

What Does it Mean?

The alternative to market timing is adopting a long-term investment approach, often summarized by the phrase “time in the market beats timing the market.” This strategy involves consistent investing over an extended period, regardless of market conditions.

Benefits of Time “In” the Market

- Reduced Stress: You’re not constantly watching the market and making frequent trades, which can be stressful.

- Compounding: The longer your money is invested, the more time it has to grow due to compound interest.

- Diversification: A long-term perspective allows you to build a more diversified portfolio, which can offer a buffer against volatility.

- Lower Costs: Less frequent trading means fewer transaction costs, allowing your investments to grow unhindered.

How to Implement Time “In” the Market

- Consistent Contributions: Make regular contributions to your investment accounts, regardless of market conditions.

- Diversification: Build a diversified portfolio that aligns with your risk tolerance and investment goals.

- Rebalancing: Periodically review and adjust your portfolio to ensure it aligns with your investment objectives.

- Patience: Be prepared to hold your investments for an extended period, resisting the urge to sell during market downturns.

By understanding the risks associated with market timing and the benefits of spending more time “in” the market, you can make more informed decisions that align with your financial goals and risk tolerance.

Behavioral Economics

Investor behavior often deviates from pure logic due to emotions, cognitive errors, or biases. Understanding these psychological traps can help you avoid costly mistakes.

Tracking and Analysis Tools

Brokerage Accounts

Platforms like Robinhood and E*TRADE offer tools for tracking and analyzing your investments.

Financial News

Stay updated with financial news from reputable sources to gain insights into market trends and economic indicators.

Investment Tools and Resources

Consider reading investment books, following finance podcasts, or taking online courses to further your investment knowledge.

Regulatory Considerations

Understanding the role of regulatory bodies like the SEC can help you make more informed decisions and protect you from fraudulent schemes.

Case Studies

Real-life case studies can offer valuable insights into investment strategies, risk management, and asset allocation.

FAQ

What is the best investment for beginners?

The best investment depends on your risk tolerance, investment goals, and time horizon.

How much money do I need to start investing?

You can start investing with as little as $100 through micro-investing apps or robo-advisors.

Glossary

- Dividend: A share of profits paid to shareholders.

- Capital Gain: Profit from the sale of an investment.

- P/E Ratio: Price-to-Earnings Ratio, a valuation metric.

- Yield: The income return on an investment.

Conclusion

Investing in the stock market may seem intimidating, but armed with the right knowledge and tools, anyone can become a savvy investor. Whether you’re a complete beginner or looking to refine your investment strategy, this guide offers a comprehensive overview to help you navigate the world of investing.

Keywords

- Investing in the stock market for beginners

- Risk tolerance

- Investment goals

- Diversification

- Stocks

- Bonds

- Mutual Funds

- ETFs

- Inflation rate

- Interest rates

- Tax considerations

- Robo-advisors

- Human advisors

- Investment strategies

- Market timing

- Behavioral economics

- Financial literacy

- Asset allocation

- Regulatory considerations

Pingback: Crypto Trading Strategies for Beginners - financecryptoinsights.com

Pingback: Master How to Track Bitcoin Price Fluctuations in Real-Time

Pingback: Effective Retirement Planning Strategies for Millennials

Pingback: Cryptocurrency for Beginners: A Comprehensive Guide - financecryptoinsights.com