Unlock the potential of the digital asset market with our comprehensive guide on how to get started with cryptocurrency trading. From understanding the basics of blockchain technology to mastering market analysis and trading strategies, this article provides you with all the essential tools you need. Whether you’re a beginner or looking to refine your skills, our guide offers actionable insights for a profitable trading experience. Dive in to explore the world of cryptocurrency trading today!

Introduction

If you’ve ever been intrigued by the world of digital assets and want to dive into cryptocurrency trading, you’ve come to the right place. The cryptocurrency market is not just about Bitcoin anymore; it has expanded to include thousands of altcoins, each with its own unique features and uses. However, the market is volatile, and understanding the basics before diving in is crucial. This guide will provide you with all the essential information you need to get started with cryptocurrency trading.

Table of Contents

- What is Cryptocurrency?

- Why Trade Cryptocurrency?

- Types of Cryptocurrency Trading

- Setting Up Your Trading Account

- Understanding Market Analysis

- Trading Strategies

- Risk Management

- Common Mistakes to Avoid

- Tools and Resources

- Final Thoughts

- FAQs

What is Cryptocurrency?

Before you start trading, it’s crucial to understand what cryptocurrency is and how it works. A cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology—a distributed ledger.

Brief History of Cryptocurrency

The concept of digital currency isn’t new. However, the first successful implementation came in the form of Bitcoin, created by an unknown person or group of people using the pseudonym Satoshi Nakamoto in 2009. Since then, the cryptocurrency market has grown exponentially, introducing various other coins like Ethereum, Ripple, and Litecoin.

How Cryptocurrencies Operate

Cryptocurrencies operate on a technology called blockchain, which is a public ledger containing all transaction data from anyone who uses a particular cryptocurrency. This decentralized nature makes it resistant to censorship and fraud.

Understanding the fundamentals of cryptocurrency will give you a better footing in your trading journey.

Why Trade Cryptocurrency?

You might be wondering why cryptocurrency trading has garnered so much attention lately. The answer lies in its unique features.

Benefits of Trading Cryptocurrency

- High Liquidity: The cryptocurrency market is open 24/7, offering high liquidity and the ability to trade at any time.

- Volatility: While risky, the high volatility in the crypto market offers the potential for high returns.

- Low Entry Barrier: Unlike traditional markets, you can start trading cryptocurrencies with a small amount of capital.

Market Liquidity and Volatility

The cryptocurrency market is known for its extreme volatility. While this poses a higher risk, it also offers opportunities for significant profits. Moreover, the market is open 24/7, providing constant liquidity and the freedom to trade at any time.

Cryptocurrency trading offers numerous opportunities, but it’s essential to know why you want to get involved.

Types of Cryptocurrency Trading

Not all cryptocurrency trading is the same; there are various types you should be aware of. Understanding these can help you choose the one that best suits your risk tolerance and investment goals.

Spot Trading

Spot trading involves buying and selling the actual cryptocurrencies. It’s straightforward and is an excellent starting point for beginners.

Margin Trading

Margin trading allows you to borrow funds to invest more than you could typically afford, increasing both potential profits and risks.

Futures Trading

Futures trading involves buying and selling contracts rather than the actual cryptocurrencies. It allows you to profit from both rising and falling markets.

Each type of cryptocurrency trading has its own set of rules and risk factors, so choose wisely based on your risk tolerance and investment goals.

Setting Up Your Trading Account

Now that you’re familiar with the basics, let’s talk about setting up your cryptocurrency trading account.

Choosing a Trading Platform

The first step is to choose a reliable trading platform. Look for platforms that are well-regarded, have good customer service, and offer a variety of trading options.

Verification Process

Most platforms will require you to verify your identity for security purposes. This usually involves providing some form of identification and may take a few days to complete.

Funding Your Account

Once verified, you’ll need to deposit funds into your trading account. Most platforms offer various methods for this, such as bank transfers, credit cards, or even using other cryptocurrencies.

A well-set trading account is your gateway to the cryptocurrency trading world.

Understanding Market Analysis

Market analysis is the backbone of successful cryptocurrency trading. There are three main types of market analysis: fundamental, technical, and sentiment analysis.

Fundamental Analysis

Fundamental analysis involves evaluating a cryptocurrency’s value based on factors like technology, team, and market demand. It’s a long-term investment strategy.

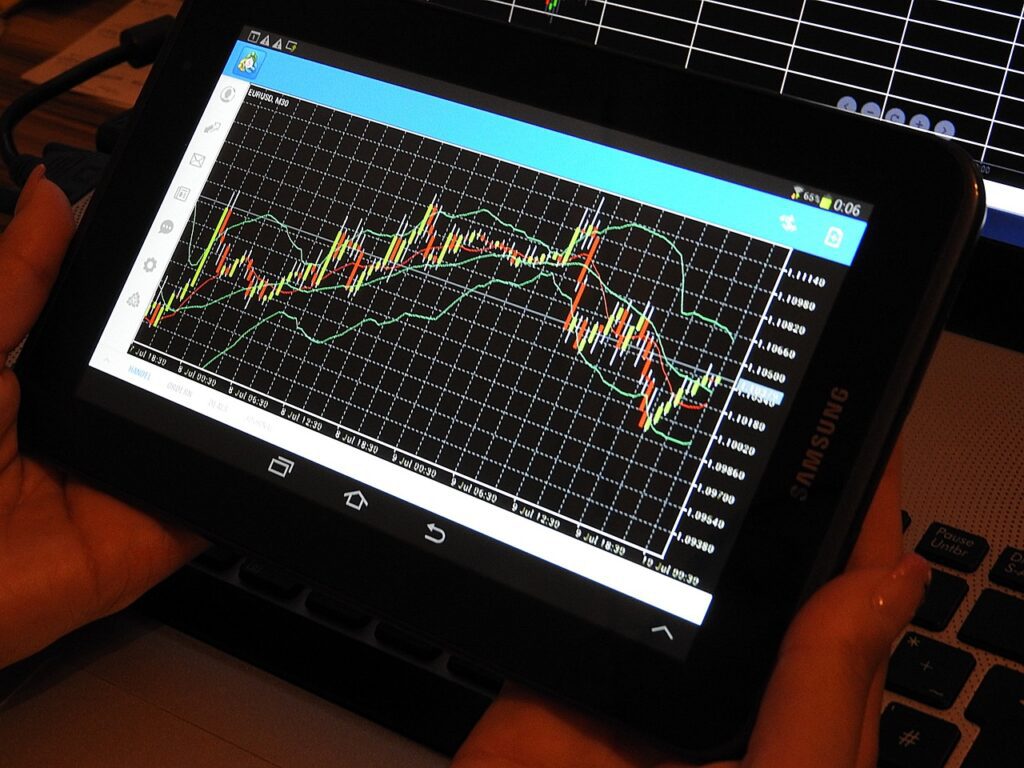

Technical Analysis

Technical analysis involves studying price charts and using statistical measures to predict future price movements. This is more suited for short-term trading.

Sentiment Analysis

Sentiment analysis involves gauging market sentiment by analyzing news articles, social media posts, and public opinion.

Effective market analysis can make or break your cryptocurrency trading experience.

Trading Strategies

A well-thought-out strategy is essential for profitable cryptocurrency trading. Your strategy should align with your trading goals, risk tolerance, and the market conditions.

Day Trading

Day trading involves buying and selling on short-term movements within the market. It requires a good understanding of technical analysis and a high tolerance for risk.

Swing Trading

Swing trading involves taking advantage of price “swings” in the market. It requires a good understanding of both fundamental and technical analysis.

Scalping

Scalping involves making a large number of small trades to profit from minute price movements. It’s a strategy best suited for high volatility markets.

Your trading strategy should align with your cryptocurrency trading goals and risk tolerance.

Risk Management

Cryptocurrency trading is not without its risks, and knowing how to manage them is crucial. Effective risk management techniques can significantly improve your success in cryptocurrency trading.

Setting Stop Losses

A stop loss is an order placed with a broker to buy or sell once the asset reaches a certain price. It’s a good way to prevent large losses in volatile markets.

Diversification

Don’t put all your eggs in one basket. Make sure to diversify your investments among different assets and trading strategies.

Position Sizing

Never risk more than you can afford to lose. A general rule of thumb is not to risk more than 1-2% of your trading capital on a single trade.

Common Mistakes to Avoid

Even seasoned traders make mistakes, but being aware of common pitfalls can save you both time and money.

Overtrading

Overtrading occurs when you trade too much, thinking that it will bring more profit, which is rarely the case.

Ignoring Fees

Trading fees can eat into your profits if not accounted for.

Emotional Trading

Letting emotions dictate your trading strategy is a surefire way to make losses.

Avoiding these common mistakes can enhance your cryptocurrency trading experience.

Tools and Resources

The right tools can make your cryptocurrency trading journey smoother and more profitable. Investing in the right tools and resources can elevate your cryptocurrency trading skills.

Trading Software

Automated trading software can help you execute trades faster and more efficiently.

Educational Resources

Books, online courses, and tutorials can provide you with the knowledge you need to become a successful trader.

Community Forums

Online communities like Reddit and Discord can be valuable sources of information and advice.

Final Thoughts: Embarking on Your Cryptocurrency Trading Journey

Cryptocurrency trading is an exciting and potentially rewarding venture if you’re well-prepared. Now that you’re equipped with the basics, you’re ready to get started with cryptocurrency trading. Remember, the key to successful trading is continuous learning and disciplined strategy execution.

FAQs

What is the best time to trade cryptocurrency?

The cryptocurrency market is open 24/7, allowing you to trade at any time that suits you.

How much capital do I need to start trading?

You can start with as little as $100, but it’s advisable to start with more to diversify your trades.

Is cryptocurrency trading taxable?

Yes, cryptocurrency trading is taxable, and you are required to report your earnings to the tax authorities.

Can I trade cryptocurrencies on my phone?

Yes, many trading platforms offer mobile apps for trading on the go.

This comprehensive guide should serve as a robust starting point for your cryptocurrency trading journey. Make sure to continually update your knowledge and stay tuned to market trends. Happy trading!

Pingback: Cryptocurrency Exchange Without KYC Enjoy Hassle-Free Trading

Pingback: The risks of cryptocurrency investment and how to Understand it. - financecryptoinsights.com

Pingback: Crypto Trading Strategies for Beginners - financecryptoinsights.com